Starting your investment journey can be both exciting and daunting, especially with the wealth of information and options available today. For beginners, it’s crucial to establish a strong foundation by understanding core investment principles and following practical steps to maximize returns. In this guide, we’ll break down simple strategies and provide key investment tips that can help you grow your wealth effectively.

Why Investing is Important for Financial Growth

Investing is one of the most powerful tools for building wealth over time. Unlike saving, which primarily preserves money, investing allows your money to grow, often at a faster rate than inflation. Starting early and making smart investment decisions can help you achieve long-term financial goals like buying a home, funding education, or securing retirement.

Investing provides a way to make your money work for you, but it requires understanding some basics. By taking the time to learn how to invest wisely, you can set yourself up for financial success.

1. Set Clear Financial Goals

Before diving into the world of investments, it’s essential to define what you want to achieve. Setting clear financial goals helps guide your investment choices and provides motivation to stay on track.

Types of Financial Goals

- Short-Term Goals: These could include building an emergency fund, saving for a vacation, or purchasing a vehicle.

- Mid-Term Goals: Examples are saving for a down payment on a home or starting a business.

- Long-Term Goals: Retirement and education funds fall into this category and often require the most planning.

Tip: Use the S.M.A.R.T. approach to set goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. This framework can help make your goals realistic and achievable.

2. Understand the Power of Compound Interest

One of the fundamental principles of investing is compound interest. When you reinvest your earnings, you earn interest on your original investment plus the accumulated interest. Over time, this can lead to exponential growth.

How Compound Interest Works

- Interest on Interest: Compound interest grows your investment by generating returns on both your principal and accumulated interest.

- The Earlier, the Better: The longer your money compounds, the more significant the growth. Starting early can drastically increase your returns.

Resource: Check out this compound interest calculator to see how your money could grow over time with consistent contributions and compounding returns.

3. Diversify Your Investments

Diversification is a strategy that helps reduce risk by spreading your investments across different asset classes. This way, if one investment performs poorly, others may compensate, reducing the impact on your overall portfolio.

Simple Ways to Diversify

- Mix Asset Classes: Include a variety of stocks, bonds, and cash equivalents in your portfolio.

- Invest in Different Sectors: Spread investments across sectors like technology, healthcare, and consumer goods.

- Use Index Funds and ETFs: These funds offer built-in diversification by holding a range of assets within a single fund.

Pro Tip: The Vanguard Total Stock Market ETF (VTI) and S&P 500 Index Fund are popular choices for beginners looking to diversify within the stock market.

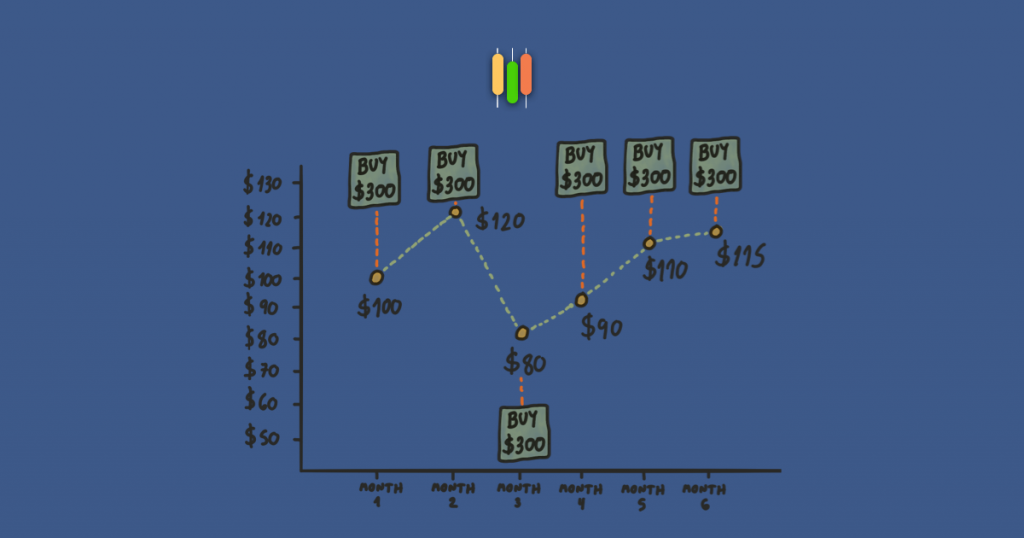

4. Start Small with Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset’s price. This approach reduces the impact of market volatility and allows you to benefit from purchasing at different price points.

Advantages of DCA

- Reduces Timing Risk: DCA removes the need to «time the market» and allows you to invest consistently.

- Builds Consistent Habits: By investing regularly, DCA fosters good financial habits.

- Reduces Emotional Investing: DCA can help you avoid emotional reactions to market fluctuations.

Example: If you’re investing in stocks, consider setting up automatic monthly contributions to an ETF or index fund to build your wealth gradually.

5. Invest in Low-Cost Index Funds and ETFs

For beginners, low-cost index funds and ETFs (Exchange-Traded Funds) are excellent options. These funds offer instant diversification, are managed passively (meaning fewer fees), and track specific indexes like the S&P 500.

Benefits of Index Funds and ETFs

- Lower Fees: Since these funds are passively managed, they often come with lower expense ratios compared to actively managed funds.

- Broad Market Exposure: Index funds and ETFs offer exposure to a wide range of stocks, making them ideal for diversification.

- Less Time-Consuming: With an index fund, you’re investing in a basket of stocks, making it simpler than picking individual stocks.

Recommended Reading: Check out the importance of low-cost ETFs and why they’re ideal for new investors.

6. Build an Emergency Fund Before Investing Heavily

An emergency fund serves as a financial cushion to cover unexpected expenses like medical bills, car repairs, or job loss. Having an emergency fund helps you avoid withdrawing investments early, which can interrupt your wealth-building journey.

How Much Should You Save?

- 3–6 Months of Living Expenses: Aim to save enough to cover at least three to six months’ worth of essential expenses.

- Use a High-Yield Savings Account: Store your emergency fund in a high-yield savings account, where it can grow slightly while remaining accessible.

Pro Tip: Establishing an emergency fund should be one of your first steps before heavily investing. This practice provides financial stability and peace of mind.

7. Stay Informed and Educate Yourself

The world of investing is always evolving, with new investment vehicles, economic trends, and financial regulations constantly reshaping the landscape. Staying informed is crucial to making sound investment decisions.

How to Stay Informed

- Read Financial News: Subscribe to reputable sources like The Wall Street Journal or Investopedia.

- Follow Market Analysts and Experts: Listen to podcasts or watch YouTube channels dedicated to personal finance and investing.

- Enroll in Courses: Online courses from platforms like Coursera or Udemy can offer in-depth knowledge on investing.

Did You Know? Understanding investment basics like asset allocation and risk management can greatly enhance your decision-making skills and increase your confidence.

8. Understand Your Risk Tolerance

Every investment involves some level of risk, and understanding your risk tolerance—how comfortable you are with potential losses—can help you choose investments that match your financial goals and personality.

How to Assess Your Risk Tolerance

- Age and Time Horizon: Younger investors can often afford to take on more risk, as they have more time to recover from potential losses.

- Financial Goals: The amount of risk you’re willing to take may depend on whether your goals are short-term or long-term.

- Personal Comfort: If market downturns make you anxious, consider lower-risk investments like bonds or dividend-paying stocks.

Resource: Use online risk tolerance questionnaires from reputable financial institutions to get an idea of your comfort level with risk.

9. Keep Costs Low and Avoid High Fees

Investment costs, such as management fees and transaction fees, can eat into your returns over time. Minimizing these fees is essential, especially for beginner investors with smaller portfolios.

How to Keep Investment Costs Down

- Choose Low-Cost Funds: Focus on ETFs and index funds with low expense ratios.

- Avoid Frequent Trading: Each transaction may come with a fee, and frequent trading can add up.

- Use Commission-Free Platforms: Many online brokers, like Robinhood and Fidelity, offer commission-free trading on stocks and ETFs.

Pro Tip: Small fee differences may not seem significant, but over time they can make a big difference in your overall portfolio returns.

10. Think Long-Term and Be Patient

Investing is a long-term strategy. Building wealth through investments requires patience, consistency, and the discipline to let your money grow over time. Avoid the temptation to constantly monitor your portfolio or react to short-term market changes, as this can lead to emotional decision-making and potentially costly mistakes.

Benefits of Long-Term Investing

- Compounding Returns: The longer you stay invested, the more you benefit from compounding growth.

- Reduced Impact of Market Volatility: Short-term fluctuations are often less significant in long-term investments.

- Goal-Oriented Approach: Focusing on your financial goals helps you remain steady and ignore market noise.

Interesting Fact: Historically, the S&P 500 has provided an average annual return of about 10%, proving that patience and consistency can yield significant results over time.

11. Rebalance Your Portfolio Periodically

As your investments grow and markets fluctuate, your portfolio’s allocation may drift from your original plan. Periodically rebalancing your portfolio helps maintain your desired risk level and ensures alignment with your financial goals.

Steps to Rebalance

- Review Asset Allocation: Check if your portfolio is aligned with your original target, such as a 70/30 mix of stocks and bonds.

- Sell Overperforming Assets: If one asset class grows disproportionately, sell a portion to bring your allocation back to your target.

- Invest in Underrepresented Assets: Use proceeds to buy more of the underrepresented asset classes.