As we step into 2024, navigating the investment landscape requires a solid understanding of current market trends, emerging sectors, and sound financial principles. Whether you’re a seasoned investor or just starting, aligning your investments with economic indicators, technological advances, and global shifts can help maximize returns.

In this article, we’ll explore some of the best investment strategies for 2024 and provide insights on where to put your money now to secure growth and build wealth.

Why 2024 is a Crucial Year for Smart Investments

The investment market in 2024 is expected to be shaped by a blend of economic recovery, technological progress, and shifting consumer demands. With the ongoing impacts of inflation and interest rate changes, plus new investment opportunities in sectors like green energy and artificial intelligence, now is the time to diversify wisely and take advantage of these trends.

Investing in a combination of traditional and innovative assets can provide financial security while allowing you to capitalize on areas with growth potential. Here are some of the top strategies for navigating the 2024 investment landscape.

1. Focus on High-Growth Technology Stocks

The technology sector continues to be a leader in growth, driven by advancements in artificial intelligence (AI), cloud computing, and 5G connectivity. As companies increasingly rely on AI to optimize processes and enhance user experiences, AI stocks and software development firms are likely to see significant growth.

Key Technology Areas to Watch

- Artificial Intelligence: From automation to data analysis, AI remains a powerful growth driver.

- Cybersecurity: As data breaches rise, demand for cybersecurity solutions is surging.

- 5G Technology: With the ongoing global rollout of 5G, companies enabling faster connectivity are well-positioned.

Pro Tip: Look for ETFs like Global X Robotics & Artificial Intelligence ETF (BOTZ) or iShares Cybersecurity and Tech ETF (IHAK) to gain broad exposure to high-growth tech companies without picking individual stocks.

2. Invest in Renewable Energy and ESG Funds

Sustainable investing, particularly in renewable energy and ESG (Environmental, Social, and Governance) funds, is becoming a cornerstone of modern portfolios. With global efforts to combat climate change, governments and corporations are increasingly investing in renewable energy projects, making this sector a smart choice for investors seeking long-term growth.

Benefits of ESG Investing

- Lower Risk: ESG companies tend to have robust governance structures and ethical practices, often leading to better risk management.

- Long-Term Growth: As regulations favor sustainable businesses, the potential for growth in this sector is substantial.

- Positive Social Impact: ESG investing allows you to support companies that prioritize ethical and sustainable practices.

Resource: For more insights, explore the Morgan Stanley ESG Fund options, which offer a variety of ESG-focused investment solutions.

3. Consider Dividend Stocks for Stability and Income

Dividend stocks are a great way to generate passive income while also benefiting from long-term stock appreciation. Many blue-chip companies, especially those in sectors like utilities, consumer goods, and healthcare, offer attractive dividend yields that can provide steady income even during market volatility.

Tips for Investing in Dividend Stocks

- Look for Dividend Aristocrats: Companies with a history of consistently increasing dividends are typically stable and reliable.

- Reinvest Dividends: By reinvesting dividends, you can benefit from compounding growth over time.

- Focus on High Yield, Low Volatility: Aim for companies with a solid history of performance and sustainable payout ratios.

ETF Option: The Vanguard High Dividend Yield ETF (VYM) is a solid choice for investors seeking diversified exposure to high-yield dividend stocks.

4. Consider Dividend Stocks for Stability and Income

Real estate has always been a go-to for building wealth, but the upfront costs can be prohibitive for some investors. Real Estate Investment Trusts (REITs) offer a more accessible alternative. These trusts allow you to invest in real estate without directly owning properties, and they often provide attractive dividend yields.

Advantages of REITs in 2024

- Affordable Entry: REITs allow for exposure to real estate at a fraction of the cost of property ownership.

- Income Potential: REITs are required to distribute a significant portion of their profits as dividends, offering regular income.

- Diversification: You can choose from various types of REITs, such as residential, commercial, or industrial, to align with your risk tolerance and financial goals.

Recommended REITs: Consider REITs like Realty Income (O) for consistent dividends or Vanguard Real Estate ETF (VNQ) for broad sector exposure.

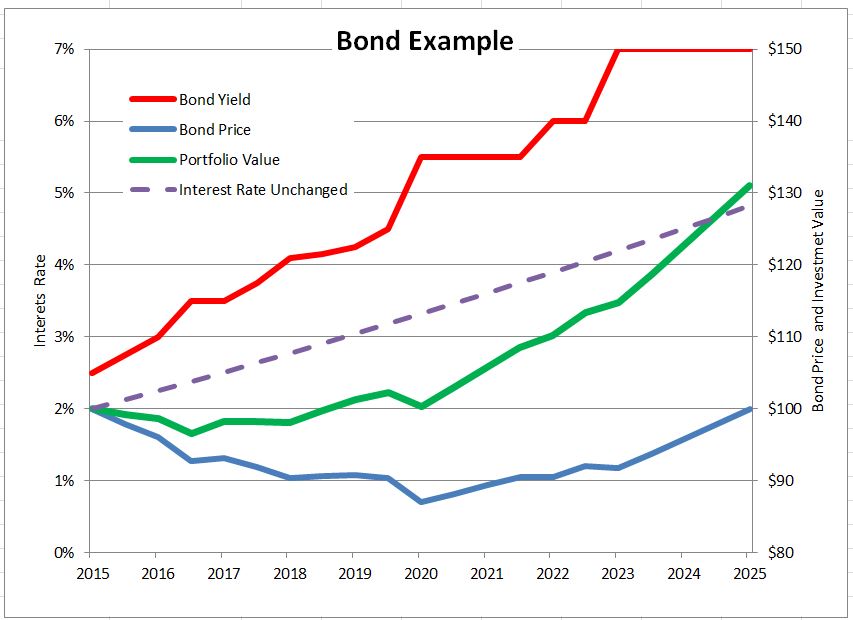

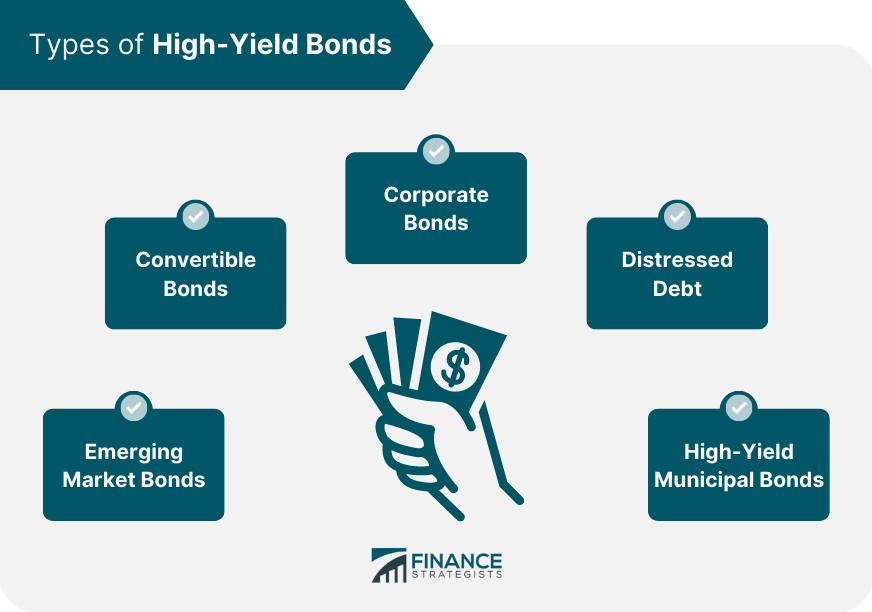

5. Prioritize High-Yield Bonds in a Rising Interest Rate Environment

As interest rates continue to rise, high-yield bonds can offer a good balance between risk and return. Bonds can be a reliable source of income, particularly in uncertain economic environments, and high-yield bonds typically offer greater returns than traditional bonds.

Types of Bonds to Consider

- Corporate Bonds: These bonds are often issued by established companies and offer higher yields compared to government bonds.

- Municipal Bonds: Known for tax advantages, municipal bonds are a smart option for investors in higher tax brackets.

- Emerging Market Bonds: With greater risk, emerging market bonds also offer higher potential yields.

Tool to Explore: The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) provides exposure to a broad range of high-yield corporate bonds for those seeking steady income.

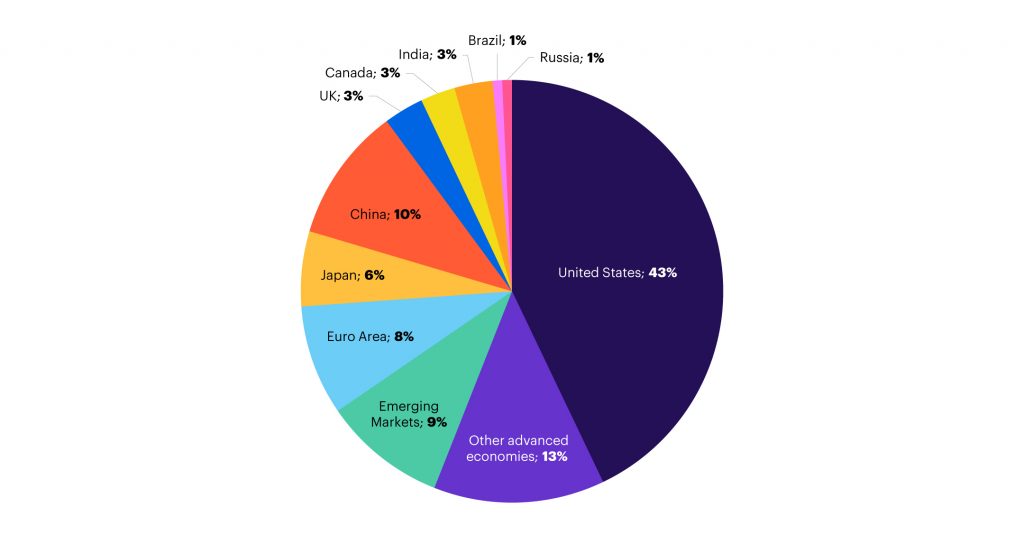

6. Consider International Markets for Diversification

Investing internationally can be a great way to diversify your portfolio and reduce dependency on the U.S. market. Emerging markets, in particular, offer growth opportunities as they recover from recent economic challenges.

Benefits of International Diversification

- Reduced Risk: Diversifying globally can reduce exposure to the volatility of a single market.

- Emerging Market Growth: Countries in Asia, Africa, and Latin America often offer faster growth than developed economies.

- Currency Diversification: International investments provide exposure to foreign currencies, which can be advantageous in fluctuating currency markets.

ETF Recommendation: The Vanguard FTSE Emerging Markets ETF (VWO) offers exposure to high-growth regions around the globe.

7. Invest in Gold and Precious Metals as a Hedge Against Inflation

Precious metals, particularly gold, are popular hedges against inflation and currency fluctuations. These assets tend to perform well during economic uncertainty and can balance a portfolio heavy in stocks and bonds.

Options for Investing in Precious Metals

- Gold ETFs: ETFs like SPDR Gold Trust (GLD) allow you to invest in gold without owning physical assets.

- Silver and Platinum: Other metals, such as silver and platinum, are also attractive due to their industrial demand.

- Physical Metals: For those who prefer tangible assets, buying physical gold or silver can be a long-term investment choice.

Consideration: Keep in mind that precious metals don’t produce income, so they should be balanced with other income-generating assets in your portfolio.

8. Explore Cryptocurrencies Cautiously

Cryptocurrency remains a high-risk, high-reward investment option. With digital currencies becoming more integrated into the financial system, and governments exploring regulations, cryptocurrencies can be a speculative but potentially lucrative addition to your portfolio.

Strategies for Investing in Cryptocurrency

- Start Small: Due to their volatility, begin with a small percentage of your portfolio, typically no more than 5%.

- Focus on Established Coins: Bitcoin and Ethereum are more established and widely accepted.

- Use a Secure Platform: Choose reliable platforms like Coinbase or Gemini to ensure your transactions and holdings are secure.

Resource: Learn more about cryptocurrency risks and best practices for secure investment.

9. Consider Index Funds for Low-Cost, Diversified Exposure

Index funds offer a simple and cost-effective way to invest in a diversified set of companies. These funds track major indexes, such as the S&P 500 or Nasdaq, and are known for their stability and low fees, making them ideal for both beginners and seasoned investors.

Advantages of Index Fund Investing

- Low Fees: Index funds typically have lower expense ratios than actively managed funds.

- Consistent Returns: By mirroring the performance of major indexes, index funds provide stable returns over time.

- Automatic Diversification: Index funds spread your investment across multiple companies, reducing risk.

ETF Suggestion: The Vanguard S&P 500 ETF (VOO) is a popular option for U.S. market exposure with low fees.

10. Keep an Eye on Real Assets and Commodities

Real assets, including commodities like oil, gas, and agricultural products, can be excellent hedges against inflation and provide exposure to sectors outside of traditional financial assets. Commodities tend to perform well during periods of economic expansion and inflation.

How to Invest in Commodities

- Commodity ETFs: Funds like Invesco DB Commodity Index Tracking Fund (DBC) allow you to invest in a diversified set of commodities.

- Direct Investment in Assets: For those with higher risk tolerance, direct investments in physical commodities or through futures contracts can provide more hands-on exposure.