Investing in the stock market can be a lucrative path to building wealth, but it’s not without its pitfalls. Many investors, especially beginners, make common mistakes that can significantly hinder their success. This article will outline the top ten mistakes to avoid when investing in the stock market, equipping you with the knowledge to navigate the complexities of investing effectively.

1. Failing to Do Your Research

One of the biggest mistakes investors make is diving into stocks without adequate research. Understanding a company’s fundamentals, industry position, and financial health is crucial.

Why Research Matters

- Informed Decisions: Research helps you make informed decisions based on data rather than emotions.

- Identifying Opportunities: Analyzing trends and financial statements can uncover potential investment opportunities.

Tip: Use resources like Yahoo Finance, Morningstar, and Seeking Alpha to conduct thorough research before making investment decisions.

2. Chasing Trends and Hot Stocks

It’s tempting to invest in stocks that are currently trending or have recently gained media attention. However, chasing after hot stocks can lead to impulsive decisions and substantial losses.

Dangers of Trend Chasing

- Overvaluation: Hot stocks may be overpriced due to hype rather than solid fundamentals.

- Market Volatility: Trends can change quickly, leading to sudden drops in stock prices.

Resource: Familiarize yourself with technical analysis to understand market trends without falling prey to fads.

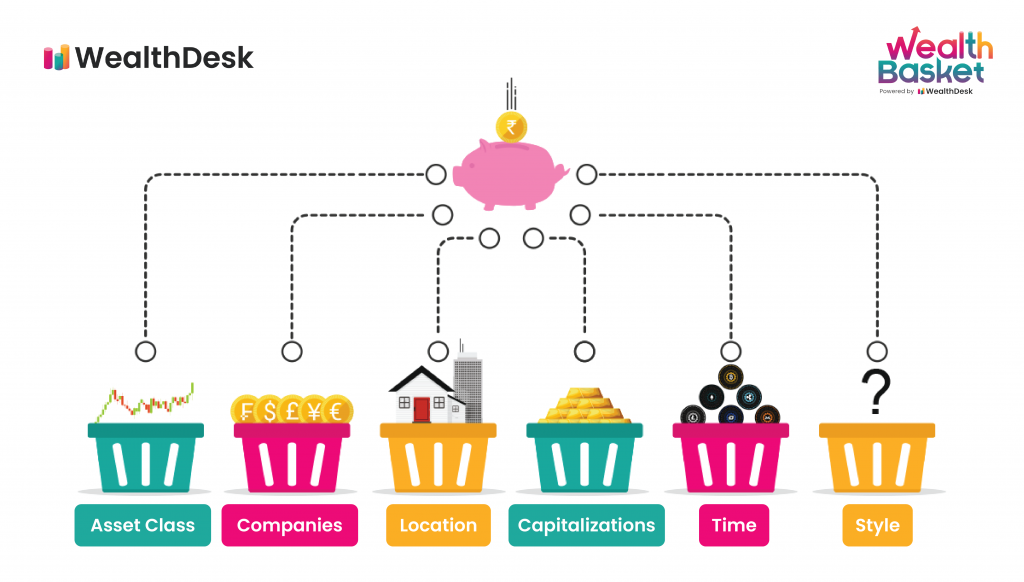

3. Neglecting to Diversify Your Portfolio

A common mistake among investors is failing to diversify their portfolios. Investing all your money in a single stock or sector increases risk significantly.

Importance of Diversification

- Risk Management: A diversified portfolio can mitigate risks by spreading investments across various assets.

- Stable Returns: Different assets react differently to market conditions, providing a more stable overall return.

Pro Tip: Consider using Exchange-Traded Funds (ETFs) or mutual funds to easily achieve diversification.

4. Timing the Market

Many investors try to time their trades to buy low and sell high, hoping to maximize profits. However, accurately predicting market movements is extremely challenging and often leads to losses.

Consequences of Market Timing

- Missed Opportunities: Waiting for the perfect moment can lead to missing out on significant gains.

- Emotional Stress: Constantly monitoring the market can lead to anxiety and impulsive decisions.

Strategy: Instead of trying to time the market, consider a long-term investment strategy and use dollar-cost averaging to smooth out your buying price.

5. Ignoring Fees and Expenses

Investors often overlook the impact of fees and expenses on their returns. High fees can erode profits over time, significantly affecting long-term investment growth.

Types of Fees to Watch For

- Management Fees: Fees charged by mutual funds or ETFs can reduce overall returns.

- Trading Commissions: Frequent trading can rack up commissions, particularly if your broker charges per trade.

Resource: Use platforms with commission-free trading to minimize costs, and always read the fee structure before investing.

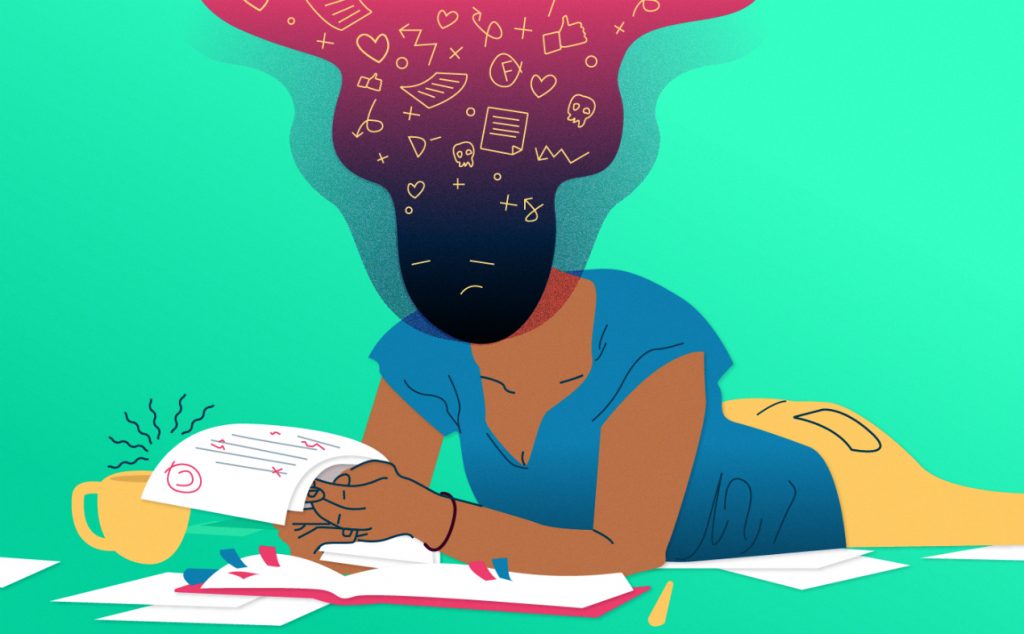

6. Letting Emotions Drive Investment Decisions

Emotional investing is one of the leading causes of poor investment choices. Fear and greed can lead to impulsive decisions, such as panic selling during market downturns or overbuying during market surges.

Effects of Emotional Investing

- Short-Term Thinking: Emotions can lead to a focus on short-term gains rather than long-term strategies.

- Increased Anxiety: Emotional swings can create a cycle of stress and poor decision-making.

Tip: Establish a clear investment plan and stick to it, regardless of market fluctuations.

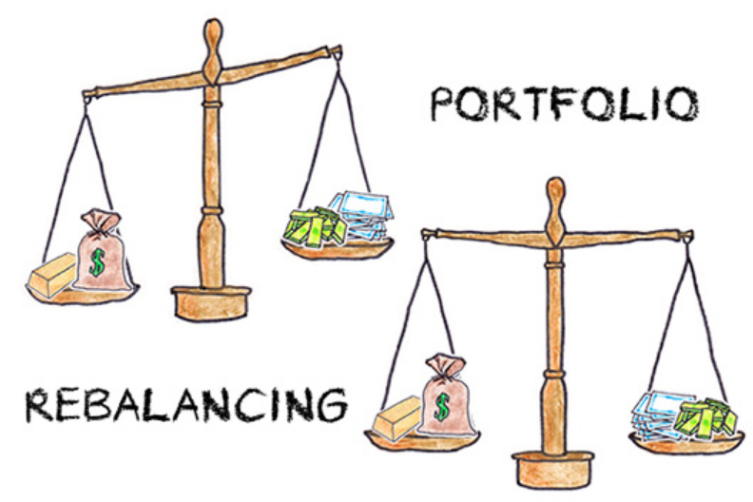

7. Neglecting to Rebalance Your Portfolio

Over time, your investment portfolio may drift from its original asset allocation due to differing performance among assets. Failing to rebalance can lead to overexposure to high-risk assets.

Importance of Rebalancing

- Risk Management: Regularly rebalancing helps maintain your desired level of risk.

- Maximizing Returns: Selling off overperforming assets and buying underperforming ones can enhance returns.

Pro Tip: Set a schedule to review and rebalance your portfolio at least once a year or whenever your allocation shifts significantly.

8. Focusing Solely on Past Performance

Investors often look at a stock’s historical performance to make future investment decisions. While past performance can provide insights, it’s not a guaranteed indicator of future success.

Risks of Relying on Historical Data

- Market Changes: Economic conditions, management changes, and industry disruptions can alter a company’s trajectory.

- Overconfidence: Assuming a stock will continue to perform well based on past success can lead to significant losses.

Strategy: Combine historical data analysis with current market trends and fundamentals when evaluating stocks.

9. Failing to Set Clear Investment Goals

Investing without clear goals can lead to a lack of direction and poor decision-making. Setting specific, measurable, achievable, relevant, and time-bound (S.M.A.R.T.) goals can help guide your investment strategy.

Benefits of Setting Goals

- Focus: Having clear goals helps you stay focused on your investment strategy.

- Motivation: Well-defined goals can motivate you to stick with your investment plan, even during market downturns.

Tip: Write down your investment goals and revisit them regularly to ensure you’re on track.

10. Ignoring Tax Implications

Investors often overlook the tax consequences of their investment decisions. Understanding how capital gains taxes, dividend taxes, and other tax implications can impact your returns is crucial.

Tax Considerations

- Long-Term vs. Short-Term Capital Gains: Long-term gains are usually taxed at a lower rate than short-term gains.

- Tax-Advantaged Accounts: Utilizing accounts like Roth IRAs or 401(k)s can provide tax benefits and help maximize returns.

Resource: Consider consulting with a tax professional or using resources from the IRS to better understand how taxes affect your investments.

Conclusion: Avoiding Common Pitfalls for Investment Success

Investing in the stock market offers significant opportunities for wealth accumulation, but avoiding common mistakes is essential for success. By conducting thorough research, diversifying your portfolio, managing emotions, and understanding fees and tax implications, you can improve your chances of achieving your financial goals.

Take the time to educate yourself and stay disciplined in your investment strategy. With careful planning and a solid understanding of the market, you can navigate the stock market with confidence and achieve long-term financial success.

4o mini