As we move toward 2024, the world of cryptocurrency continues to evolve at a breakneck pace. Innovations, regulatory developments, and market dynamics are shaping the landscape in unprecedented ways. This article explores the anticipated trends and predictions for cryptocurrency in 2024, offering insights that can help investors, enthusiasts, and industry stakeholders navigate this volatile yet promising market.

The State of Cryptocurrency in 2023

Before diving into predictions for 2024, it’s essential to understand the current state of cryptocurrency. The market has faced significant challenges and opportunities, including:

- Increased Adoption: Cryptocurrencies are gaining traction in mainstream finance, with more businesses accepting them as payment. Major companies, including Tesla and Square, have already embraced Bitcoin, while Ethereum continues to dominate the smart contract space.

- Regulatory Scrutiny: Governments worldwide are beginning to formulate clearer regulations surrounding cryptocurrencies. This scrutiny has led to mixed reactions in the market, fostering both concern and optimism about the future.

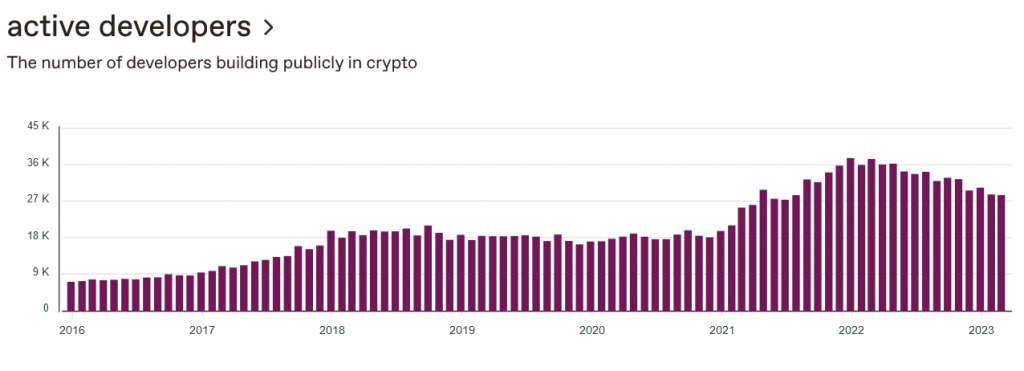

- Technological Innovations: Advancements in blockchain technology, such as layer-2 scaling solutions and cross-chain interoperability, are enhancing the functionality and efficiency of cryptocurrencies. This progress will likely drive further adoption and investment.

Resource: For a comprehensive overview of the current state of the cryptocurrency market, visit CoinMarketCap’s Cryptocurrency Overview.

Key Trends to Watch in 2024

1. Regulatory Developments

As cryptocurrencies become more integrated into the financial system, regulation will play a crucial role in shaping the market. In 2024, we can expect:

- Clearer Guidelines: Governments and regulatory bodies will likely establish clearer guidelines for cryptocurrency exchanges and Initial Coin Offerings (ICOs). This will help protect investors and reduce fraudulent activities.

- Taxation Frameworks: Countries may implement more defined tax regulations for cryptocurrency transactions, making it easier for investors to comply and understand their tax obligations.

2. Enhanced Security Measures

Security has always been a top concern in the cryptocurrency space. In 2024, we anticipate:

- Improved Wallet Security: With the rise in the number of hacks and scams, wallet providers will enhance security measures. Solutions such as multi-signature wallets and biometric authentication will become more prevalent.

- Regulatory Compliance Tools: Companies will invest in compliance technologies to ensure they meet regulatory requirements, mitigating the risk of penalties and increasing trust among users.

3. Rise of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) has revolutionized the financial landscape by providing services without intermediaries. In 2024, DeFi is expected to:

- Gain Mainstream Adoption: More users will embrace DeFi platforms for lending, borrowing, and trading, drawn by the promise of higher returns and lower fees compared to traditional finance.

- Integration with Traditional Finance: We may see further collaboration between DeFi platforms and traditional financial institutions, leading to hybrid models that leverage the strengths of both systems.

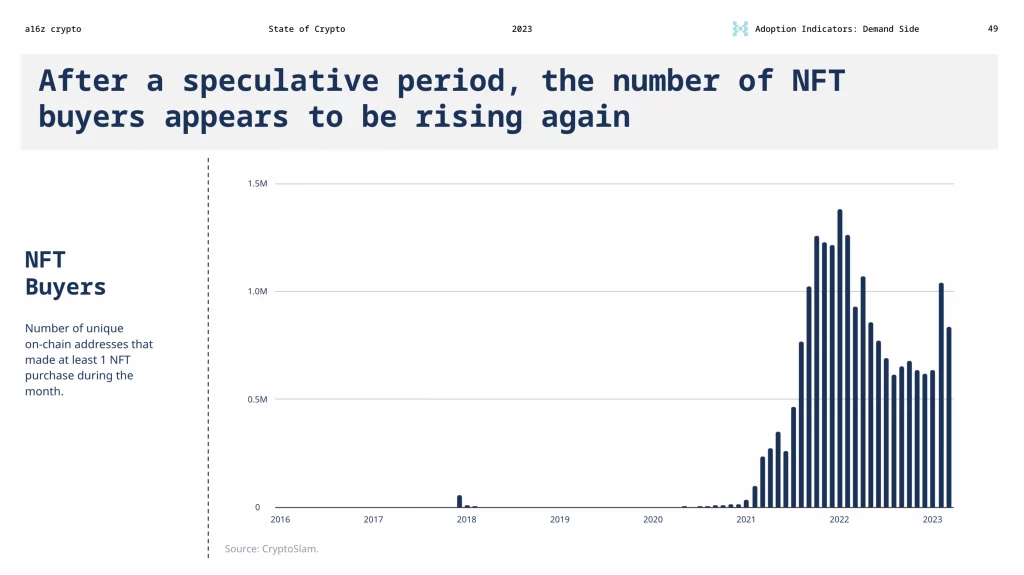

4. Growing Interest in Non-Fungible Tokens (NFTs)

NFTs have taken the art and entertainment worlds by storm, and their potential applications are expanding. In 2024, we can expect:

- Increased Use Cases: Beyond art and collectibles, NFTs will find applications in various sectors, including gaming, real estate, and music. This diversification will broaden the market for NFTs.

- Interoperability: Improved interoperability between different blockchain networks will enable users to trade and utilize NFTs across platforms seamlessly, enhancing their liquidity and utility.

Resource: For insights into the evolving world of NFTs, explore Nifty Gateway for the latest trends and releases.

5. Focus on Sustainability

Environmental concerns have become a significant topic in the cryptocurrency community, particularly regarding the energy consumption of mining. In 2024, we predict:

- Adoption of Eco-Friendly Protocols: More cryptocurrencies will adopt eco-friendly consensus mechanisms like Proof of Stake (PoS), which requires less energy compared to traditional Proof of Work (PoW) systems.

- Green Initiatives: Blockchain projects that focus on sustainability will gain traction, and investors will increasingly favor projects with a commitment to environmental responsibility.

Predictions for the Cryptocurrency Market in 2024

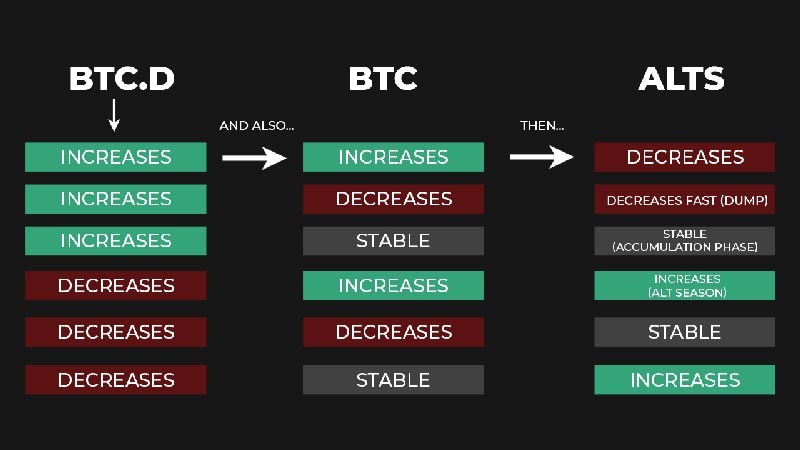

1. Bitcoin’s Continued Dominance

Bitcoin will likely maintain its position as the leading cryptocurrency, serving as a store of value akin to digital gold. We can expect:

- Price Growth: Analysts predict that Bitcoin’s price may rise significantly as institutional adoption increases and inflation concerns persist.

- Market Sentiment: As Bitcoin solidifies its status as a mainstream asset, positive market sentiment will likely encourage new investors to enter the space.

2. Ethereum’s Evolution

Ethereum will continue to be at the forefront of smart contract technology and decentralized applications (dApps). Expectations for Ethereum in 2024 include:

- Ethereum 2.0 Success: The transition to Ethereum 2.0, which promises scalability and reduced energy consumption, will attract more developers and users to the network.

- Increased Adoption of dApps: As more businesses and developers recognize the advantages of building on Ethereum, the number of dApps will grow, driving further usage of the Ethereum network.

3. The Emergence of New Cryptocurrencies

While Bitcoin and Ethereum dominate the market, we can anticipate the emergence of new cryptocurrencies that address specific needs, such as:

- Privacy Coins: As privacy concerns grow, cryptocurrencies focused on anonymity and secure transactions, such as Monero and Zcash, may gain popularity.

- Stablecoins: Stablecoins will likely see increased usage as a bridge between traditional finance and cryptocurrencies, providing stability in a volatile market.

4. Institutional Investment

Institutional investors will continue to play a significant role in the cryptocurrency market. Predictions include:

- Increased Participation: More hedge funds, family offices, and corporate treasuries are expected to allocate a portion of their portfolios to cryptocurrencies, further legitimizing the asset class.

- Product Innovation: Financial products related to cryptocurrencies, such as ETFs and futures, will become more common, offering investors diversified ways to gain exposure.

Conclusion

As we look ahead to 2024, the cryptocurrency landscape is poised for substantial transformation. Key trends such as regulatory developments, the rise of DeFi, the growth of NFTs, and a focus on sustainability will shape the future of this dynamic market.

Investors, enthusiasts, and industry participants must stay informed about these trends and adapt their strategies accordingly. The world of cryptocurrency offers immense potential, but with it comes volatility and risk. By understanding the landscape and positioning themselves wisely, individuals can navigate the exciting opportunities that lie ahead.

For ongoing updates and insights into the cryptocurrency market, consider following reliable news sources and joining community forums to engage with fellow enthusiasts. The future of cryptocurrency is bright, and being informed will be the key to success in this rapidly evolving environment.

4o mini